Tax collections from individual Americans last year

reached their highest share of the U.S. economy in seven years while

corporate tax revenue again lagged historical averages, a new

congressional report showed on Monday.

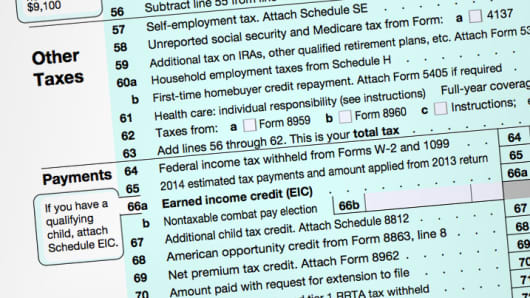

The Joint Committee on Taxation (JCT) said in a review of the tax system that individual federal income tax receipts were 8.1 percent of gross domestic product (GDP) in fiscal 2014. That level was last achieved in 2007 before the financial crisis plunged the economy into its worst recession since the 1930s.

Read MoreRetirement: Minimize taxes to maximize savings

As large companies clamor for tax code reforms aimed at reducing corporate rates, the JCT data show individual wage-earners and business owners who treat their firms' profits as personal income are bearing an increasing share of the U.S. tax burden.

The Joint Committee on Taxation (JCT) said in a review of the tax system that individual federal income tax receipts were 8.1 percent of gross domestic product (GDP) in fiscal 2014. That level was last achieved in 2007 before the financial crisis plunged the economy into its worst recession since the 1930s.

Read MoreRetirement: Minimize taxes to maximize savings

As large companies clamor for tax code reforms aimed at reducing corporate rates, the JCT data show individual wage-earners and business owners who treat their firms' profits as personal income are bearing an increasing share of the U.S. tax burden.

Meanwhile, federal corporate income tax collections were

just 1.9 percent of GDP, up slightly from the past two years, but below

the 2.6 percent average since 1950.

Social insurance taxes, which include Social Security and Medicare taxes collected from workers' wages, rose to 5.9 percent of GDP, well above the 4.9 percent

historical average, but below the 6 percent range recorded during most of the 1980s, 1990s and 2000s, including 6.2 percent in 2009.

The JCT data also highlighted the growing trend of an increasing share of business income earned by "pass-through" entities, such as sole proprietorships, partnerships and S-corporations. In these types of firms, profits are taxed as income for the individual owners and partners, not as corporate income.

Read MoreThis is how billionaires enjoy super-low 20% taxes

In 2012, the latest year in the report, 1.64 million U.S. corporate tax returns were filed, down about a quarter from 2.18 million in 2000.

By contrast, there were 23.5 million returns from owners of sole proprietorships in 2012, up 31 percent from 17.9 million in 2000. The report showed strong growth in tax returns from partnerships and S-corporations as well.

The shift away from the traditional corporate tax structure, or C-corp, has complicated Congress' tax reform efforts. While some lawmakers advocate pursuing a simpler corporate-only tax reform to lower rates while closing many tax deductions and credits, House Ways and Means Committee Chairman Paul Ryan has argued that this would leave the increasingly important pass-through sector at a competitive disadvantage.

Ryan has insisted that any corporate reforms include provisions to deal with such pass-through entities.

Social insurance taxes, which include Social Security and Medicare taxes collected from workers' wages, rose to 5.9 percent of GDP, well above the 4.9 percent

historical average, but below the 6 percent range recorded during most of the 1980s, 1990s and 2000s, including 6.2 percent in 2009.

The JCT data also highlighted the growing trend of an increasing share of business income earned by "pass-through" entities, such as sole proprietorships, partnerships and S-corporations. In these types of firms, profits are taxed as income for the individual owners and partners, not as corporate income.

Read MoreThis is how billionaires enjoy super-low 20% taxes

In 2012, the latest year in the report, 1.64 million U.S. corporate tax returns were filed, down about a quarter from 2.18 million in 2000.

By contrast, there were 23.5 million returns from owners of sole proprietorships in 2012, up 31 percent from 17.9 million in 2000. The report showed strong growth in tax returns from partnerships and S-corporations as well.

The shift away from the traditional corporate tax structure, or C-corp, has complicated Congress' tax reform efforts. While some lawmakers advocate pursuing a simpler corporate-only tax reform to lower rates while closing many tax deductions and credits, House Ways and Means Committee Chairman Paul Ryan has argued that this would leave the increasingly important pass-through sector at a competitive disadvantage.

Ryan has insisted that any corporate reforms include provisions to deal with such pass-through entities.

No comments:

Post a Comment