Investors interested in bitcoin shouldn't be troubled by

the digital currency's sharp price decline, according to two of its most

high-profile advocates.

Bitcoin, the online currency that is "mined" by computer operators who solve complex mathematical puzzles, has seen its value decline amid a series of scandals and setbacks. It most recently traded on Coinbase at around $271, well off the heady days of late-November 2013 when it hit $1,145, and down 67 percent over the past 12 months.

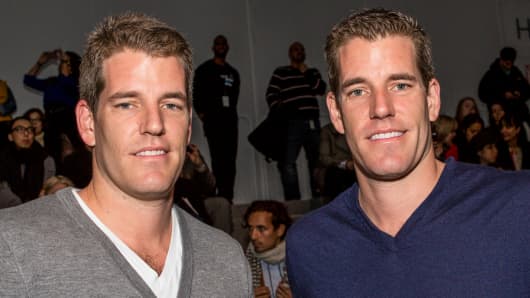

Tyler and Cameron Winklevoss—the Winklevoss twins, or the "Winklevii" as they are sometimes referred to on Wall Street—believe in the product and pitched it

Monday to fund pros gathered at ETF.com's InsideETFs conference in Hollywood, Florida.

Bitcoin, the online currency that is "mined" by computer operators who solve complex mathematical puzzles, has seen its value decline amid a series of scandals and setbacks. It most recently traded on Coinbase at around $271, well off the heady days of late-November 2013 when it hit $1,145, and down 67 percent over the past 12 months.

Tyler and Cameron Winklevoss—the Winklevoss twins, or the "Winklevii" as they are sometimes referred to on Wall Street—believe in the product and pitched it

Monday to fund pros gathered at ETF.com's InsideETFs conference in Hollywood, Florida.

About that big price drop: Well, Tyler Winklevoss said there's no reason to fear.

Read MoreBitcoin 'BearWhale' rattles cryptocurrency world

"In the last few weeks the price has been kind of low. I view that as a buying opportunity. We have never sold bitcoin," he said. "For people who love volatility, or like to trade between different markets and stuff, there's plenty there. But we're more taking a long-term view."

The twins have a vested interest in the digital currency's future: They await regulatory approval of a bitcoin-based exchange-traded fund and recently announced the launch of Gemini.com, which will establish a centralized trading platform.

Read MoreBitcoin gets first regulated US exchange

The site would pair with Winkdex.com, which aggregates prices from various bitcoin exchanges currently operating.

"This is our effort to bring bitcoin mainstream, to build it into a regulatory box," Cameron Winklevoss said. "When we think of Gemini.com, it will be like a Nasdaq for bitcoin."

The currency's biggest obstacle has been overcoming a multitude for bad headlines, from the collapse last year of Mt.Gox, which to that point had been the most well-known trading center, to another issue of bitcoin digital wallets being compromised at Bitstamp.

Read MoreUnique ETFs to spice up your portfolio

Tyler pointed out the difference between those two episodes in particular: Investors lost money when Mt.Gox collapsed, but Bitstamp customers were made whole.

"The narrative behind bitcoin has been dominated by bad behavior," he said. "The reality is bitcoin is filled with tons of talented developers building infrastructure."

Read MoreBitcoin 'BearWhale' rattles cryptocurrency world

"In the last few weeks the price has been kind of low. I view that as a buying opportunity. We have never sold bitcoin," he said. "For people who love volatility, or like to trade between different markets and stuff, there's plenty there. But we're more taking a long-term view."

The twins have a vested interest in the digital currency's future: They await regulatory approval of a bitcoin-based exchange-traded fund and recently announced the launch of Gemini.com, which will establish a centralized trading platform.

Read MoreBitcoin gets first regulated US exchange

The site would pair with Winkdex.com, which aggregates prices from various bitcoin exchanges currently operating.

"This is our effort to bring bitcoin mainstream, to build it into a regulatory box," Cameron Winklevoss said. "When we think of Gemini.com, it will be like a Nasdaq for bitcoin."

The currency's biggest obstacle has been overcoming a multitude for bad headlines, from the collapse last year of Mt.Gox, which to that point had been the most well-known trading center, to another issue of bitcoin digital wallets being compromised at Bitstamp.

Read MoreUnique ETFs to spice up your portfolio

Tyler pointed out the difference between those two episodes in particular: Investors lost money when Mt.Gox collapsed, but Bitstamp customers were made whole.

"The narrative behind bitcoin has been dominated by bad behavior," he said. "The reality is bitcoin is filled with tons of talented developers building infrastructure."

No comments:

Post a Comment