Greece's place in the euro zone has been on a knife edge

since elections this year handed control to the anti-austerity Syriza

Party. Some prominent economists have warmed to the idea of a "Grexit" but it appears the world of business remains optimistic.

A survey of chief financial officers (CFOs) by CNBC has revealed that the overwhelming majority of European executives - a total of 75 percent - believe that Greece will remain in the monetary union but will have negotiated different terms and conditions by this time next year.

The topic has roiled global markets this year, especially in Athens where Greek banking stocks have seen erratic intraday movements. Last week provided further key developments with proposals for an extension to Greece's loan agreement being rejected by Germany.

A survey of chief financial officers (CFOs) by CNBC has revealed that the overwhelming majority of European executives - a total of 75 percent - believe that Greece will remain in the monetary union but will have negotiated different terms and conditions by this time next year.

The topic has roiled global markets this year, especially in Athens where Greek banking stocks have seen erratic intraday movements. Last week provided further key developments with proposals for an extension to Greece's loan agreement being rejected by Germany.

On Sunday, Greek finance minister Yanis Varoufakis was due

to send draft reform proposals to the International Monetary Fund and

EU institutions following a deal on Friday to extend the country's

rescue program by four months.

There has also been talk of capital controls for Greece to stem the outflow of cash and emergency liquidity has also been provided to keep the country's banks afloat. Despite progress made last year, the Syriza Party has hopes to overhaul the nation's bailout program with European institutions, alleviate its debt burden. and try to reduce austerity in a country that has been gripped by high unemployment.

There has also been talk of capital controls for Greece to stem the outflow of cash and emergency liquidity has also been provided to keep the country's banks afloat. Despite progress made last year, the Syriza Party has hopes to overhaul the nation's bailout program with European institutions, alleviate its debt burden. and try to reduce austerity in a country that has been gripped by high unemployment.

None of the CFOs surveyed believed that Greece would stay

in the bloc under the terms of its 240 billion euro ($270 billion)

bailout, while 17 percent believed that it

was still too soon to say either way. Additionally, one respondent predicted that Greece would be existing outside the euro zone, "on its own," by this time next year.

Mohamed El-Erian, the chief economic adviser at German-based Allianz, told CNBC on Tuesday last week that a Greek exit from the euro would cause "short-term chaos," but stated that it would not bring the global economy to its knees. On Thursday last week, Hans-Werner Sinn, president of the Munich-based Ifo Institute for Economic Research, told CNBC that Greece's creditors needed to "face the truth" and realize the country is bankrupt and advocated a return to the drachma for the struggling euro zone nation.

Fifty-one CFOs from Europe and also Asia make up the CNBC CFO Global Council survey. Both groups were asked about government involvement in business operations and how big a say regulators had in their individual industries. 61 percent of respondents said that government involvement was too large, 22 percent even said that they "strongly agreed" that policymakers were too involved with the way they do business. Just 11 percent disagreed with the statement.

was still too soon to say either way. Additionally, one respondent predicted that Greece would be existing outside the euro zone, "on its own," by this time next year.

Mohamed El-Erian, the chief economic adviser at German-based Allianz, told CNBC on Tuesday last week that a Greek exit from the euro would cause "short-term chaos," but stated that it would not bring the global economy to its knees. On Thursday last week, Hans-Werner Sinn, president of the Munich-based Ifo Institute for Economic Research, told CNBC that Greece's creditors needed to "face the truth" and realize the country is bankrupt and advocated a return to the drachma for the struggling euro zone nation.

Fifty-one CFOs from Europe and also Asia make up the CNBC CFO Global Council survey. Both groups were asked about government involvement in business operations and how big a say regulators had in their individual industries. 61 percent of respondents said that government involvement was too large, 22 percent even said that they "strongly agreed" that policymakers were too involved with the way they do business. Just 11 percent disagreed with the statement.

Regulators have been stepping up their efforts in recent

years, especially in the financial sector which has been picking up the

pieces after the global financial crash of 2008. Financial watchdogs

have been keen to show they are picking up on misdeeds but other sectors

have also felt the full force of the law. Last week, General Electric's

12.4-billion-euro ($4.08 billion) bid for Alstom's power equipment

business came under the microscope, according to Reuters who cited three

people familiar with the matter. The news agency said the deal is

likely to face a full-scale investigation by EU antitrust regulators.

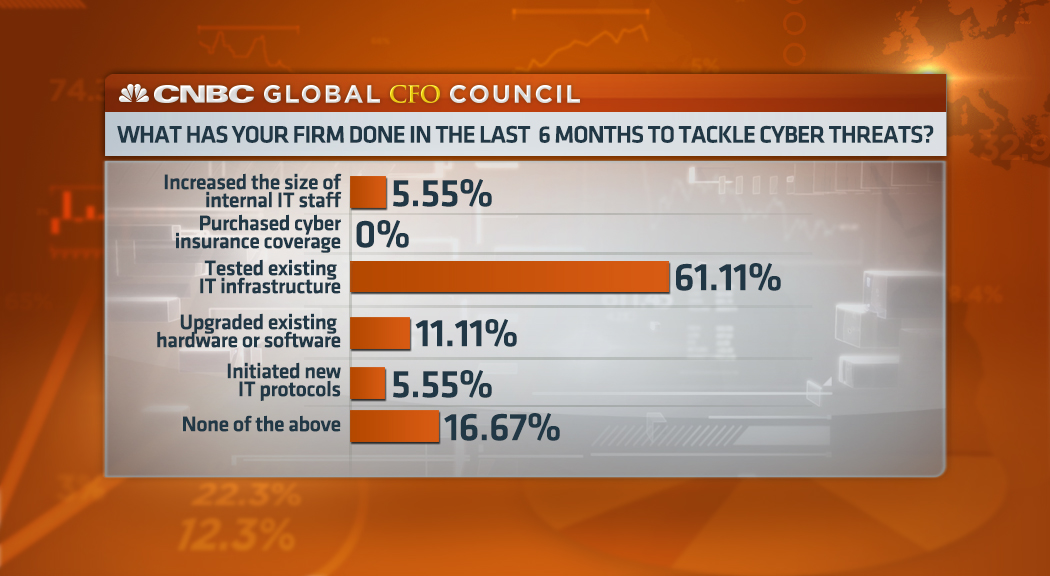

Meanwhile, it appears that global companies are growing wiser to the threat of cybercrime that has already hit high-profile firms such as Sony and JPMorgan. Of the CFOs surveyed, 61 percent said that their companies had tested or audited its existing infrastructure in the last six months so as to reduce its vulnerabilities to cyber threats.

A further 11 percent said they had replaced or upgraded their existing hardware or software while over 5 percent had increased their staffing numbers to tackle the growing problem.

Meanwhile, it appears that global companies are growing wiser to the threat of cybercrime that has already hit high-profile firms such as Sony and JPMorgan. Of the CFOs surveyed, 61 percent said that their companies had tested or audited its existing infrastructure in the last six months so as to reduce its vulnerabilities to cyber threats.

A further 11 percent said they had replaced or upgraded their existing hardware or software while over 5 percent had increased their staffing numbers to tackle the growing problem.

No comments:

Post a Comment